Weekly: Is That It?

Yields and Fed expectations rise, this time with little impact on digital asset prices

STRATEGY: Is that it? Meaningful moves higher in Fed expectations and yields have occurred in recent weeks, yet bitcoin & digital assets have yet to respond to the downside. Perhaps this uptick in Fed Fund pricing creates better opportunities to “buy the dip.” Continue buying bitcoin and ether pullbacks with an eye on the 200-day moving average for support. This strategy is supported by:

Continued lack of meaningful contagion within crypto, particularly in the “forced selling” realm

Price resilience following an uptick in Fed Fund expectations and yields across the curve. Bitcoin continues to trade above $20,000

Continued strength in underlying fundamentals. This week, I highlight record highs in addresses holding bitcoin as well as the percentage of supply held for various time horizons

The growing probability of a “soft landing” (a more resilient than expected economy, continued disinflation, a robust labor market, and decent equity earnings = “good enough” foundation for risk assets after an incredibly tough year)

A continued rally in equities that increases the relative value of crypto off its highs

The systematic signal of price > 200D moving average, now at $19,761

Risks to this strategy include:

A further uptick in Fed Fund expectations (5.5% - 6%)

Surprising crypto contagion news leading to forced selling.

2/22/2023

Weekly Strategy Note: Is That It?

Since the hotter-than-expected nonfarm payrolls report on February the 3rd, Fedspeak (mostly Bullard & minutes) have tilted hawkish, higher for longer expectations have risen, and yields have moved higher.

But this time, with much less impact on both digital asset and equity prices.

Let’s quantify the recent moves. From the close on February 2nd (prior to the employment report) to yesterday’s (February 21st) close:

2YR Yield: 4.10 → 4.72 (+60bps)

10Yr Yield: 3.39 → 3.94 (+55bps)

30YR Yield: 3.54% → 3.97% (+43bps, curve flattening)

Implied Fed Funds for March ‘23: 18% chance of 50bps to 5.25%

Implied Fed Funds for September ‘23: 5.5%, new peak

Implied Fed Funds for December ‘23: 5.25%, new peak

Implied Fed Funds for December ‘24: 4.75%

S&P 500: -4.4%

Bitcoin: +3.1%

Ether: +0.3%

DXY: +2.4%

So: four-month highs in US yields, new highs in peak Fed Funds expectations, and very few cuts priced for both 2023 and 2024, all occurring relatively quickly in recent weeks.

Given last year’s events, one would expect that this type of action wreaks havoc on equity and digital asset prices.

But that’s recency bias.

In this environment, risk assets have responded quite well to changing expectations. More tightening and a retracement in yields, yet bitcoin is up 3.1%, and the S&P 500 has only fallen 4.4%. The two are up 46.3% and 4.1 year-to-date - not too shabby.

New highs in Fed pricing has not led to new lows in digital assets and equities - take this as a signal.

While some of bitcoin’s KPIs hit record highs last week (I discuss below), the macroeconomic picture is less uncertain, and as a result, some confidence has been restored. Similar to my comments last week, I remind:

The “soft landing” probability continues to rise, with an overarching disinflationary trend and continued strength in the labor market as the Fed nears their peak Fed Funds rate (4.75% current, 5.5% expectations)

Through 450bps of tightening, the US is on pace for three straight quarters of economic expansion

Equities have rallied over 11% since putting in a cycle low in October

Earnings growth for Q4 ‘22 has declined just 1.4% year-over-year

So, until further data presents itself, this “bigger picture” of macro improvements should dominate over the near-term hawkish worries. Remember: “one point does not a trend make.”

The latest rise in yields may be their “last stand higher” - and if so, this is where the opportunity lies.

Therefore, my strategy remains: “continue buying bitcoin and ether pullbacks with an eye on the 200d moving average for support.” Perhaps this uptick in Fed Fund pricing creates better opportunities for digital asset investors that were hesitant to “buy the dip” throughout the second half of 2022. Bitcoin’s 200d moving average stands around $19,761.

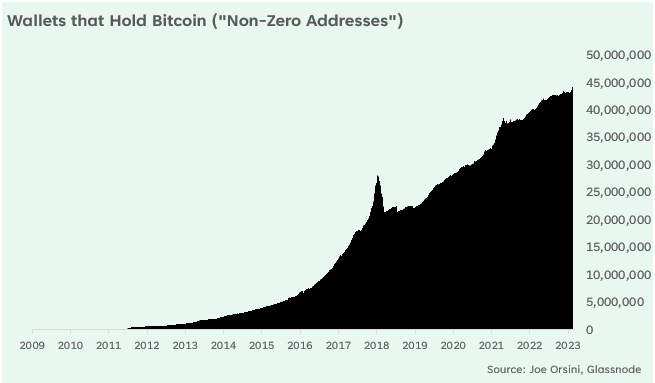

Bitcoin KPIs: This week, Non-Zero Addresses & Holding Trends

The rally in price, alongside interest in NFTs on bitcoin (called “Ordinals”), have led to new all-time highs in the number of on-chain addresses that hold the asset. There are now approximately 40 million wallets that own bitcoin.

While total crypto adoption is believed to be higher (~300 million from crypto.com’s study), I view these “Non-Zero Addresses” as a more accurate assessment of bitcoin’s true ownership. This represents the number of users that have taken their holdings off exchanges and into custody for true use as a store of value or medium of exchange:

Further, the percentage of supply held for 1, 2, 3, and 5-year horizons reached record highs last week as well. As of 2/21/23, the percentage of supply:

Held Longer Than 1 Year: 67.0%

Held Longer Than 2 Years: 50.5%

Held Longer Than 3 Years: 39.1%

Held Longer Than 5 Years: 28.2%

To simplify, more and more users are now owning bitcoin, even holding the asset for longer and longer periods of time.

This highlights bitcoin’s growing and continued success as an emerging monetary asset and store of value, now just 14 years of age.

Sounds like bitcoin is doing just fine in this environment.

STRATEGY: Is that it? Meaningful moves higher in Fed expectations and yields have occurred in recent weeks, yet bitcoin & digital assets have yet to respond to the downside. Perhaps this uptick in Fed Fund pricing creates better opportunities to “buy the dip.” Continue buying bitcoin and ether pullbacks with an eye on the 200-day moving average for support. This strategy is supported by:

For illustration, I color code the chart for when bitcoin’s price is above the 200-day moving average (green) and below (red). This simple indicator is a clear and simple “signal” for those looking to identify the longer-term trend.

We can identify 17 occurrences when bitcoin’s price flipped above or below the 200D moving average, illustrating a robust signal for long-term trend following.

Stay Tuned,

Joe Orsini, CFA, CMT