Weekly: Pieces of the Puzzle

Sensationalists hang on one month of inflationary data - yet disinflationary trends exist, and pieces of the puzzle indicate risk appetite remains.

STRATEGY: A recent rise in inflationary data has offered pundits, bears, and skeptics a time to shine - yet pieces of the puzzle signal that risk appetite remains. Continue buying bitcoin and ether pullbacks with an eye on the 200D moving average for support, now $19,731 and $1,431. Next week’s nonfarm payrolls and the following week’s CPI are key catalysts and opportunities ahead of the Fed meeting on 3/22. “One point month does not a trend make.” Soft landing remains in sight.

The continued disinflationary trend (“one

pointmonth does not a trend make”)Digital asset price resilience through equity volatility: Fed expectations have hit highs, yet bitcoin continues to trade well above the $20,000 level

Continued strength in underlying fundamentals. Last week, I discussed bitcoin holding trends and non-zero addresses, this week I highlight active address growth for Bitcoin and Ethereum

The growing probability of a “soft landing” (a more resilient than expected economy, disinflationary trends, a robust labor market, and decent equity earnings = “good enough” foundation for risk assets after an incredibly tough year)

The likelihood of October as the cycle low in equities and its significance in the relative value of crypto well off its highs

The systematic signal of price > 200D moving average, now at $19,761

Risks to this strategy include:

A further uptick in Fed Fund expectations (6%) leading to defensive equity positioning and a meaningful bitcoin break below the 200d moving average

New, surprising crypto contagion news leading to forced selling

3/2/2023

Weekly Strategy Note: “Pieces of the Puzzle”

At last, February comes to an end - a month that included ups and downs, positives and negatives, and most importantly, a quick change to market participant sentiment.

While many became bullish after strong December and January performance, a resurgence in “hot data” came throughout the 28 days in February, spooking the minds of investors that again believe inflation will stick throughout 2023. This data included (as well as key catalysts ahead):

And as a result - bond yields across the world moved higher. German yields (the entire curve) reached new highs, while so did the US 2YR. Importantly, the US 10YR climbed above 4%, a key psychological level and reference point. As of 3/2’s close:

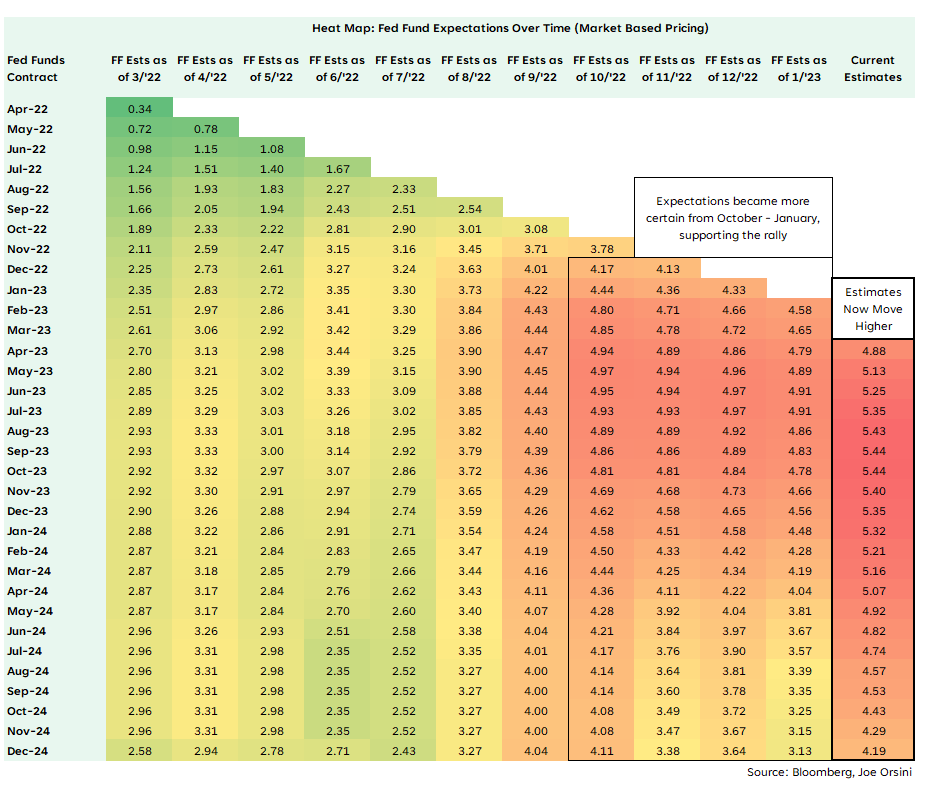

And naturally, Fed expectations have risen:

Markets now price in a 5.5% peak policy rate by the July 26th meeting, and just a 5% chance of a cut to 5.25% by the end of the year.

How quickly things changed, on the surface and in the news, just from a month’s worth of data.

Of course, skeptics, pundits, and permabears are hanging on these new Fed expectations - sensationalism sells. Of course, markets have rallied off the lows, and the bears have pushed back their timelines to later this year. “You just wait!" they say.

But all of that is noise. Here’s a signal. Fed expectations are the highest they’ve been in this cycle, yet the pieces of the puzzle indicate risk appetite has re-emerged:

The Nasdaq Composite has outperformed the S&P 500 year-to-date (+9.5% vs +3.7%)

Cyclicals have outperformed defensives (+5.3% vs -1.7%)

Speculative equities have surged (GS nonprofitable tech +14.5%)

Smalls have outperformed large (Russell 2K +7.8% vs S&P +3.7%)

And most importantly, bitcoin and ether have outperformed equities (BTC +35.9%, ETH +31.7%)

This type of performance is not what bears want to see.

Remember - uncertainty creates volatility, and investors have a lot more information than they did through the drawdowns that began in March and August of last year. I remind:

450bps of tightening in 12 months, yet:

Final Q3 GDP = +3.2% | Advance Q4 GDP = +2.9% | Estimate Q1 GDPnow = +2.3%

U-3 unemployment = 3.4% | weekly initial jobless claims consistently < 250k

S&P 500 earnings “collapse” -3.0% Q4 | bottom-up 2023E +10.6%

Signal vs. noise, signal vs. noise.

Now, get this:

Nonfarm payroll for February (3/10) estimated at 220k, lower than the 517k print (there will also be revisions)

US CPI for February (3/14) estimated at the headline: 0.4% m/m | core: 0.3% m/m, both lower than previous prints

Should this data come in as expected, the disinflationary trend still exists (annualized pace including these estimates highlighted in orange):

And this is why it’s important to understand that “One point month does not a trend make.” Should next week’s NFP and the following CPI come in at expectations - fear from January data would quickly move to the rear-view mirror. Then, look out above.

Until then, perhaps this bout of market sentiment and Fed pricing creates better opportunities for digital asset investors to “buy the dip.” Thus far, bitcoin has pulled back just ~12% and ~13% from its rally highs - a disappointing percentage for those that were fearful last year when bitcoin was below $20k.

Note that bitcoin continues to trade well above its 200d moving average, now $19,731. Any opportunity around this level would be ideal, yet the asset remains impressively resilient, even in the wake of the Silvergate news (many exchanges have already moved to Signature - Silvergate’s failure is not due to crypto itself, but aggressive banking practices.)

Intermarket, monitor the S&P 500’s hold of the 200D moving on 3/2/2023 as a potential pullback bottom - this sets up well for a rally should next week’s data come in around expectations.

The 4% level on the 10yr treasury serves as a reference point - again with my belief that this is likely the last move higher in yields in this cycle. Monitor this level as a “line in the sand.” The dollar has found resistance around 105.3 as interest rate differentials tighten between the US and developed markets (US - Germany, for instance).

Of course, these markets will all move together - and very quickly.

This Week: Active Address Growth

Despite the bear market in price, active addresses for both the Bitcoin and Ethereum networks remain resilient - highlighting the significant adoption taking place despite price weakness.

Bitcoin’s average daily active addresses reached 962,282 by the end of February, while Ethereum’s reached 422,188. Year-over-year, this is 3.8% and -18.5% growth, even with price down about -47% and -44% in the same period.

Note Ethereum’s decline as evidence of its cyclical nature: its use requires an interest in applications such as DeFi, Gaming, Services, and Scaling - which rises in better economic environments and digital asset bull markets.

The use of bitcoin is less reliant on economic sentiment: its primary use-case is a monetary asset, a store of value/medium of exchange.

This data illustrates that certainly, “all is not lost.” Resilient underlying use with price in a significant drawdown certainly sounds like continued adoption of new and emerging technologies.

What an opportunity that is presented for long-term investors.

STRATEGY: A recent rise in inflationary data has offered pundits, bears, and skeptics a time to shine - yet pieces of the puzzle signal that risk appetite remains. Continue buying bitcoin and ether pullbacks with an eye on the 200D moving average for support, now $19,731 and $1,431. Next week’s nonfarm payrolls and the following week’s CPI are key catalysts and opportunities ahead of the Fed meeting on 3/22. “One point month does not a trend make.” Soft landing remains in sight.

For illustration, I color code the chart for when bitcoin’s price is above the 200-day moving average (green) and below (red). This simple indicator is a clear and simple “signal” for those looking to identify the longer-term trend.

We can identify 17 occurrences when bitcoin’s price flipped above or below the 200D moving average, illustrating a robust signal for long-term trend following.

Stay Tuned,

Joe Orsini, CFA, CMT