STRATEGY: More bad news within the “crypto” industry, yet bitcoin puts in the best quarter since 2021. Idiosyncratic headlines are not great on perception, but also, not great in impacting price either. Bitcoin remains incredibly resilient - as it should in today’s environment. Continue to buy dips, yet monitor the impact of Fed expectations (100bps of cuts are priced in, which could change). Eye the rising 200D moving average for support, now over $20,000. My year-end target of $48,000 remains in place. This strategy is supported by:

A strong reminder of the willing backstops provided by both fiscal and monetary groups, highlighting core tenets of bitcoin’s investment theses: 1) continued policy willingness to spend versus verifiable scarcity, 2) banking counterparty risk versus on-chain transparency, ad 3) the ability to “be your own bank”

The likely end of tightening, given continued disinflation (Feb PCE < expected)

Digital asset price resilience through equity volatility: bitcoin has reached a high of ~$28,700, up 71% YTD

A resilient US consumer, disinflationary trends, a robust labor market, and decent equity earnings as a “good enough” foundation for risk assets after an incredibly tough year. GDPnow estimates 2.5% for Q1 (economic growth through all the noise)

The still-likely October as the cycle low in equities, and what a better equity market means for digital asset relative value

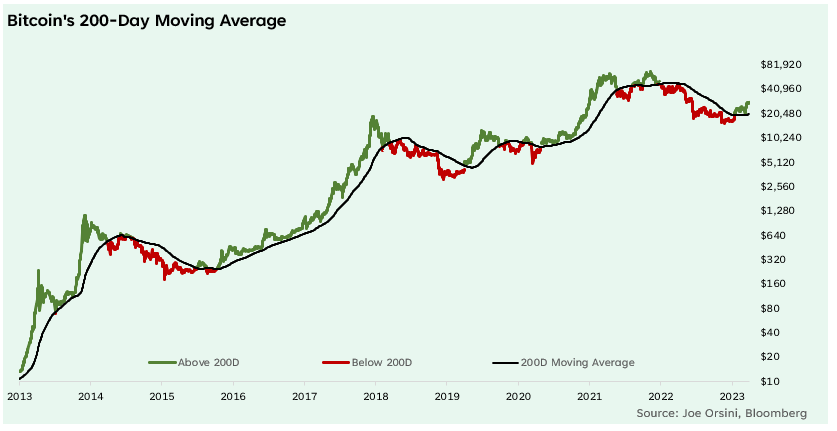

The systematic signal of price > 200D moving average, now $20,340

Continued strength in underlying fundamentals. I’ve recently discussed bitcoin holding trends, non-zero addresses, and active address growth for Bitcoin and Ethereum

Risks to this strategy include:

Resurge in inflation, impacting Fed cut estimates (100bps is a lot, 75 is more reasonable - how does this, if any, impact bitcoin (gold will also signal))

Regulatory crackdown on bitcoin specifically (do note that cleaning up the last of the wild-west is necessary, and even improve bitcoin’s relative value versus alts. I also do not foresee negative bitcoin specific regulation)

3/31/2023 Strategy Note

“Idio-what?”

Well, bitcoin is ready to put in its best quarter since Q1 2021, currently up 71% at time of writing.

When considering “where we’ve come from” I’d say most market participants least expected a rally of this caliber.

While I remained positive in 2022 given the likelihood of a “not all that bad” macro environment we’re now experiencing (no economic collapse, a resilient consumer, everything listed in the supporting strategy details)… attractive valuations with MVRV < 1 for much of the second half of 2022 made purchases of bitcoin rather straight forward for long-term investors.

Unfortunately, most bitcoin analysts on “crypto twitter” were fear mongering prices to go lower. Calls for $10,000 flooded the twitterverse in an effort to gain the spotlight, followers, and a speaker label on the twitter “school of spaces.”

But boy - were the bears wrong. The idiosyncratic risks - while on the right path - had little impact on price. Ironically, the FUD led to much of the news being “priced in.”

It goes without saying that the recent headlines are downright embarrassing for the industry. Along with the list from last week, Binance has now been sued by the CFTC, with serious allegations around kyc/aml, trading against customers, encouraging VPN loopholes for US citizens, and even allowing small transfers from terrorists. SBF of FTX is in even more trouble than before, with new allegations of Chinese bribery.

The industry at this point couldn’t look much worse, yet bitcoin couldn’t look better.

The news since November of 2022 certainly highlights the importance of macro conditions over idiosyncratic headline risk when it comes to bitcoin’s price action.

While the banking “crisis” drove awareness, the markets expectations of cuts, alongside a technical “failed breakdown” and the move above the 200D moving average have certainly supported rally year-to-date.

See bitcoin’s correlation with gold as evidence of benefitting from changing Fed expectations.

Going forward, this is where the risk lies.

While we received further information regarding the disinflationary trend today with February PCE coming in less than expected (headline 0.3% vs 0.3% est, 0.6% prior & core 0.3% vs 0.4% est, 0.6% prior), 100 basis points of cuts is rather extensive (even given disinflation) should there be “no crisis.”

We have the good ole’ nonfarm payroll next week, and for better or worse, the NYSE is closed on that day (“Good Friday.”)

Should the market begin pricing in less cuts than 100 bps (trust me, I’ll be following), we will see how bitcoin responds to that environment.

For now - resistance remains at $28,500, a failure to hold this level would likely garner some profit taking and sellers. A move above would indicate continuation of this active sequence, with the next key level around $31,500. Near-term support lies around $27,000.

Remember a retracement is always possible after a strong quarter. But as I say - markets are systematic. This would likely coincide with the aforementioned possibilities of changing Fed expectations (see Dec ‘23 Fed Funds) and would be signaled by both dollar and gold for further indication. Equity volatility should be monitored, if any, even as correlations have come down. It is important to note that both the S&P 500 and the Nasdaq have had stellar quarters (+7.0% and +16.7%, respectively) - and pieces of the puzzle indicate risk appetite certainly remains.

My price target remains $48,000 for this year, in which I explained in my previous note.

Remember, nothing goes up in a straight line. Bitcoin is above the 200D moving average (and the 50D) - so all is well for long-term investors :).

Updated Technical Chart:

Those looking to buy a “deeper dip” than what has been offered can eye the now rising 50D moving average. More short-term, one can utilize the 8D EMA, often used by active traders.

Next week, digital asset sector talk.

STRATEGY: More bad news within the “crypto” industry, yet bitcoin puts in the best quarter since 2021. Idiosyncratic headlines and risk are not great on perception, but also, not great in impacting price either. Bitcoin remains incredibly resilient - as it should in today’s environment. Continue to buy dips, yet monitor the impact of Fed expectations (100bps of cuts are priced in, which could change). Eye the rising 200D moving average for support, now over $20,000. My year-end target of $48,000 remains in place.

For illustration, I color code the chart for when bitcoin’s price is above the 200-day moving average (green) and below (red). This simple indicator is a clear and simple “signal” for those looking to identify the longer-term trend.

We can identify 17 occurrences when bitcoin’s price flipped above or below the 200D moving average, illustrating a robust signal for long-term trend following.

Stay Tuned,

Joe Orsini, CFA, CMT

Great analysis!