Weekly: Runs, Rescues, and Rallies

Bitcoin shines through banking uncertainty and new dovish Fed expectations

STRATEGY: That was quick. Bitcoin dropped to the “ideal” $19,731 level I discussed yet offered little reason to buy the dip given stablecoin uncertainty. The bounce off the 200D moving average and rally this week is significant, highlighting what’s to come when the Fed eventually hits the brakes. The hold of the 200D moving average further confirms the likelihood of a bull market, sooner than most expected. Continue to buy dips with an eye on the 200D moving average for support.

Get your popcorn ready for FOMC, the market is now pricing in multiple cuts by the end of the year. This positive bias and strategy is supported by:

A strong reminder of the willing backstops provided by both fiscal and monetary groups, highlighting core tenets of bitcoin’s investment theses: 1) continued policy willingness to spend, versus verifiable scarcity, 2) banking counterparty risk versus on-chain transparency, 3) the ability to “be your own bank”

Further signs of being near the end of monetary tightening, and in fact, the Fed’s banking facility as a hidden, quasi-form of easing. ($297bn rise in the Fed’s balance sheet, meaning half of QT was reversed in just one week)

The continued disinflationary trend (which matters less, but is still important. Note CPI came in as expected, and PPI lower than expected)

Digital asset price resilience through equity volatility: bitcoin reached $27k in early Friday trade

A resilient US consumer, disinflationary trends, a robust labor market, and decent equity earnings as a “good enough” foundation for risk assets after an incredibly tough year. Recent crises mean the soft/hard/no landing is “up-in-the-air”, but Fed policy management is now more important. Note economy still strong, GDPnow ~3.2% est for Q1’23.

The still-likely October as the cycle low in equities, and what a better equity market means for digital asset relative value

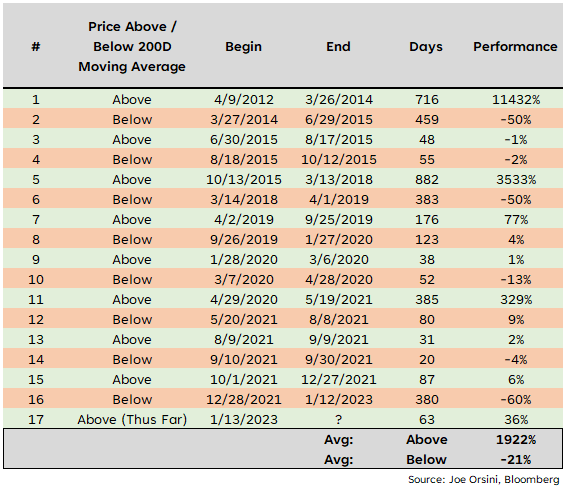

The systematic signal of price > 200D moving average, now $19,817

Continued strength in underlying fundamentals. I’ve recently discussed bitcoin holding trends, non-zero addresses, and active address growth for Bitcoin and Ethereum

3/17/23 Strategy Note

Runs, Rescues, and Rallies

What a week - bank runs, government rescues, and bitcoin rallies throughout all of the panic. A week nothing but historic.

We’ve all heard the news, but a quick recap:

SVB declined -60% on Thursday 3/9 after it took a $1.8bn loss on a bond portfolio fire sale, leading to a raise of $2.3bn through sales of stock…

…panic and fear ensued, and a bank run on SVB and other regional banks began…

…this created uncertainty around nearly all regional banks in the US…

…while at the same time in Europe, Credit Suisse was feared to go under…

With these events, US yields made a drastic move lower (the 2yr has moved from 5.08% to 3.96% at the time of writing), the yield curve steepened abruptly, and market expectations of the Fed’s policy rate moved dramatically lower:

But don’t worry, fiscal and monetary groups, alongside some bulge bracket banks, were quickly here to save the day:

The FDIC insured all depositors of SVB and Signature Bank, setting a new precedent

The Fed created a new facility “BTFP” to support other regional banks in need (some say a quasi-stimulus)

11 US banks contributed $30bn of capital to save the First Republic

and the Swiss National Bank loaned Credit Suisse 50bn CHF

Incredibly,

the Fed’s balance sheet rose $297 billion, half of which from loans to these banks in need, but also contrary to QT and potentially reversing trend

use of the Fed’s discount window (at a 4.5% interest rate) rose $148bn on the week

and even still, the ECB hiked 50 basis points (likely setting a roadmap for the Fed’s likely 25 next week)

Throughout all of these events, however:

Equities actually rallied (SPX + 1.5% WTD at time of writing),

the Nasdaq outperformed (Nas +4% WTD, tech continues to lead)

and most importantly, digital assets rallied big time, led by bitcoin (as it should, in this environment) (bitcoin +24%, ether +12 WTD).

Mini-banking crisis? Bitcoin was made for this. The asset can store value with no limit and send value without a bank - “insured” by your private seed phrase. No runs on the bitcoin network and no need for FDIC bailouts. “Be your own bank" has a lot of truth to it.

Fed showing signs of stimulus? Bitcoin was made for this. Bitcoin’s proven, verifiably scarce supply contrasts with the monetary inflation seen in the USD over time.

Concerns of counterparty and credit risk? Bitcoin itself has none. While bank swaps and the likes are opaque, every single bitcoin transaction is fully available through any block explorer.

Consider this: the quick and swift measures taken by the Treasury and the Fed were needed - but again, shows the increasing willingness for them to step in at the onset of any crisis. This fits perfectly within the long-term bitcoin thesis.

And of course, now that the market sniffs a potential change in the Fed’s path - bitcoin rallies significantly, with a perfect bounce off of the 200D moving average:

The best part is that the rally to $27,000 is it’s relatively quiet. All of the noise was when bitcoin was hitting $16,000 after FTX. Soon: “wait what? Bitcoin is 27k right now?”

Your patience has been rewarded: prices are now back to June 2022 levels.

Next week, I’ll provide a year-end price target for bitcoin, offering my readers a better perspective on where I believe bitcoin can head this year. Stay tuned!

Upcoming Focus:

Next week’s Fed meeting is now the major focus, in which I believe the Fed will hike 25 basis points as expected and in tune with the ECB’s hike as well.

The real new question is whether the market is correctly pricing in upcoming cuts. Essentially, a pivot is now priced in, which could create a disappointing Wednesday, should Powell continue his “talk tough” rhetoric.

Monitor Fed fund pricing for December ‘23 and ‘24 as further indications of participants’ views on Fed policy.

In terms of bitcoin’s price action, holding ~$25,200 is important for active traders.

Remember - markets move systematically. Monitor the 2yr yield (rate expectations), equities (risk appetite), the dollar (rate expectations vs. RoW), and gold (Fed hawkish/dovish), for further signals of market perception. The continued outperformance of tech highlights risk appetite, as I wrote in the “pieces of the puzzle” note a few weeks ago.

For long-term investors, do not ignore the significant resilience bitcoin has illustrated. There is a likelihood that this cycle low was ~$15,500, which compares to ~$3,100 post-2017 cycle.

The successful test of the 200D moving average should be more than enough for long-term investors to be excited about a new bull market.

STRATEGY: That was quick. Bitcoin dropped to the “ideal” $19,731 level I discussed yet offered little reason to buy the dip given stablecoin uncertainty. The bounce off the 200D moving average and rally this week is significant, highlighting what’s to come when the Fed eventually hits the brakes. The hold of the 200D moving average further confirms the likelihood of a bull market, sooner than most expected. Get your popcorn ready for FOMC, the market is now pricing in multiple cuts by the end of the year. Supporting details can be found at the bottom of this note.

For illustration, I color code the chart for when bitcoin’s price is above the 200-day moving average (green) and below (red). This simple indicator is a clear and simple “signal” for those looking to identify the longer-term trend.

We can identify 17 occurrences when bitcoin’s price flipped above or below the 200D moving average, illustrating a robust signal for long-term trend following.

Stay Tuned,

Joe Orsini, CFA, CMT